Get Approved For Business Finance In As Little As 24 Hours

Whether you’re a new ABN or scaling fast we match you with the right lender in minutes. No major bank bottlenecks. No endless paperwork.

answer a few quick questions to see if your qualified

Why Choose Loan Market Glenelg?

At Loan Market Glenelg, we make finding the right loan simple and stress-free. Our mortgage experts connect you with the best home, SMSF, investment, or business loans from over 60 lenders, tailored to your unique situation.

Whether you’re a first-home buyer, investor, or business owner, we guide you through every step—handling complex cases, low deposits, or self-employed income—so you can make confident financial decisions.

With Adelaide-based expertise and nationwide lender access, we provide a transparent, supported process from enquiry to settlement, helping you save time, reduce stress, and secure the loan that fits your goals.

Why Choose Loan Market Glenelg?

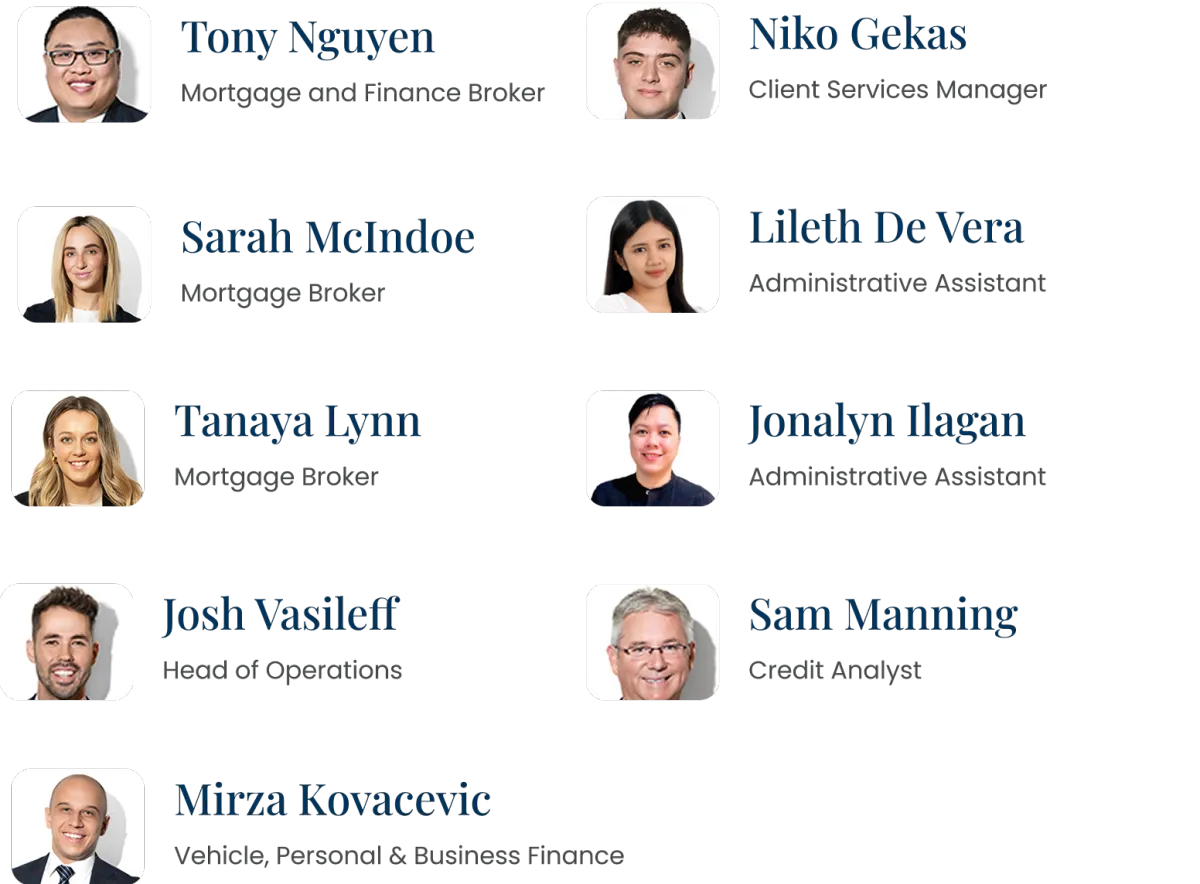

Tony Nguyen

Mortgage and Finance Broker

Sarah McIndoe

Mortgage Broker

Tanaya Lynn

Mortgage Broker

Josh Vasileff

Head of Operations

Mirza Kovacevic

Vehicle, Personal & Business Finance

Niko Gekas

Client Services Manager

Lileth De Vera

Administrative Assistant

Jonalyn Ilagan

Administrative Assistant

Sam Manning

Credit Analyst

At Loan Market Glenelg, we make finding the right loan simple and stress-free. Our mortgage experts connect you with the best home, SMSF, investment, or business loans from over 60 lenders, tailored to your unique situation.

Whether you’re a first-home buyer, investor, or business owner, we guide you through every step—handling complex cases, low deposits, or self-employed income—so you can make confident financial decisions.

With Adelaide-based expertise and nationwide lender access, we provide a transparent, supported process from enquiry to settlement, helping you save time, reduce stress, and secure the loan that fits your goals.

Watch Video

How It Works

We make finding the right loan simple and stress-free. Follow our easy 4-step process:

Take The 60-Second Quiz

Answer a few simple questions to help us understand your needs.

We Match You With Lenders

Our team reviews your profile against 60+ lending options.

Receive Expert Guidance

Get tailored advice for the loan that suits your needs.

Secure Your Loan

From approval to settlement, we guide you every step.

Our Services

We offer a wide range of loan solutions to meet your financial goals

Home Loans

First-time buyers, refinancing, and investment properties.

Asset Finance

Fund tools, machinery, or other business assets.

Business Loans

Support growth, equipment, or expansion financing.

Commercial Loans

Offices, warehouses, and investment properties.

Construction Loans

Flexible finance to build your dream home.

Personal Loans

Cover holidays, education, or unexpected costs.

Car Loans

Competitive rates for new or

used vehicles.

SMSF Loans

Use your super to invest in property with compliance and guidance.

Personal Loans

Cover holidays, education, or unexpected costs.

What Makes Us different?

Your own personal, non-bank affiliated loan expert

Free for you1

We work in your best interests (we’re not owned by a bank)

Fast turnaround times2

Access to over 60+ banks and lenders in one place3

Ongoing support and guidance once your loan has settled4

Loan

Market

Banks & lenders

Your own personal, non-bank affiliated loan expert

Free for you1

We work in your best interests (we’re not owned by a bank)

Fast turnaround times2

Access to over 60+ banks and lenders in one place3

Ongoing support and guidance once your loan has settled4

Large Call to Action Headline

Loan Market

Banks & lenders

Testimonials

The staff have been very supportive to me throughout the years. They always seem happy to answer questions and help wherever needed.

Iwould recommend!

-Celine C.

Loan Market Glenelg

I recently refinanced with Loan Market. Tony and the team were great to deal with! They made the process very comforting and was always avallable to answer any questions.

Highly recommend.

-Mark R.

Loan Market Glenelg

Frequently Asked Questions

Can I Qualify With A Low Deposit Or Self-Employed Income?

Yes! We specialize in complex scenarios including ABN income and low deposits.

Is SMSF Property Investing Risky?

Not if done correctly. Our team ensures full compliance and structured lending for safety.

How fast will I Hear Back After Taking The Quiz?

Within 24 business hours, a broker will contact you to discuss your options.

Do I need perfect credit?

No. We work with a wide range of lenders who consider your full financial situation.

How Do I Get Started?

Simply take our quick 60-second quiz to see which loans match your profile.

Ready To Find Your Perfect Loan?

Take the first step towards securing the right loan for you.

All Copyright Reserved © 2025 Loan Market